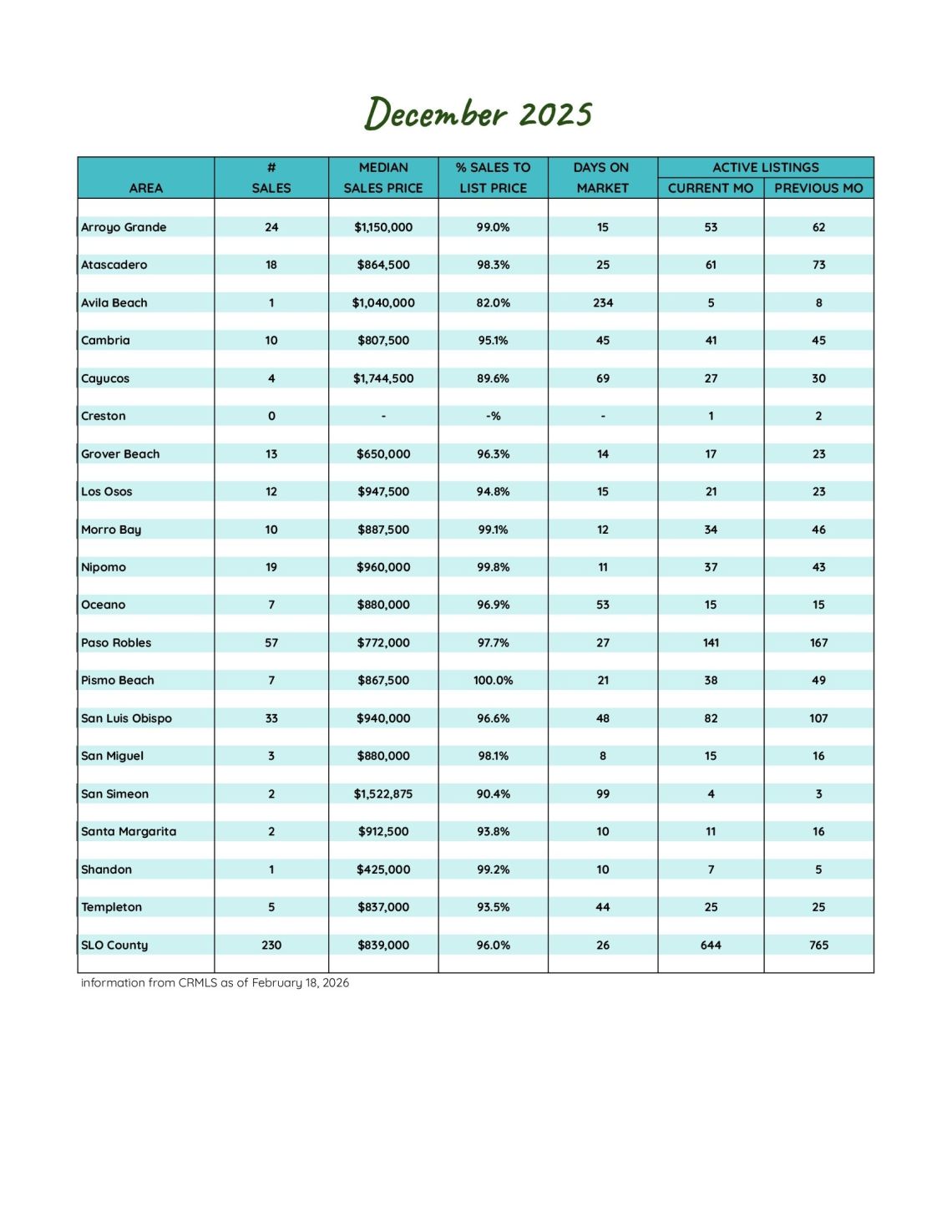

San Luis Obispo County December 2025 Market Update

Year Ends with Tightening Inventory, Strong Closings, and Softer Pricing Trends

As 2025 comes to a close, the San Luis Obispo County housing market reflects a seasonal slowdown paired with notable strength in closed sales. December’s data shows fewer new listings, tightening inventory, and a surge in year-end closings, while pricing metrics indicate slight softening as buyers gain negotiating leverage.

Inventory Trends: Fewer New Listings, Supply Contracts

New listings declined in December to 161 homes, down 16.6% from November’s 193 but up 13.4% compared to December 2024’s 142. Active listings dropped sharply to 644, a 17.0% decrease month-over-month and slightly below last year’s 652.

With months of supply falling to 2.9 from 3.6 in November, inventory tightened significantly, creating a more competitive environment than seen in the prior months.

Sales Activity: Closings Surge Despite Fewer Pendings

Buyer activity showed mixed signals. Pending sales dipped to 172, down 8.0% from November but up 33.3% from a year ago. Meanwhile, closed sales surged to 230, a 25.7% jump from November and 16.8% higher year-over-year, reflecting strong follow-through from earlier contracts.

Roughly 26% of homes sold above list price, and nearly 25% went under contract within 10 days, demonstrating that well-priced homes continue to attract strong demand.

Pricing and Market Pace: Buyers Gain Some Ground

Pricing softened slightly in December. The average sales price declined to $1,018,289, down 0.4% month-over-month and 7.3% compared to last year. Price per square foot fell to $558, also down both monthly and annually.

The list-to-sale price ratio improved slightly to 95.5%, though it remains below last year’s level, signaling continued buyer leverage. Homes spent an average of 55 days on market, a modest increase from both November and last December, reflecting a more measured pace.

Luxury and Community Highlights

Luxury activity remained a key component of the market, with 14 sales exceeding $2,000,000 and a top sale of $3,580,000. Four communities maintained average sales prices above $1 million, while two remained below $750,000, highlighting the wide range of price points across the county.

What It Means for Buyers and Sellers

For sellers, reduced inventory creates opportunity, but pricing strategy remains critical as buyers become more selective. Homes that are well-prepared and competitively priced are still selling quickly—and sometimes above asking.

For buyers, increased negotiating power compared to last year, combined with slightly softer pricing, offers a window of opportunity, even as limited inventory keeps competition alive for desirable properties.

As the market transitions into 2026, conditions point toward a balanced but tightening landscape—less frenetic than peak periods, yet still active and opportunity-driven for both sides.

161

New Listings

2024: 142

644

Active Listings

2024: 652

172

Under Contract

2024: 129

230

Closed Sales

2024: 197

Homes Sold

95.5%

Sale-to-List Price

2024: 96.8%

$1,018,289

Avg Sales Price

2024: $1,098,486

2.9

Months of Supply

2024: 3.0

55

Avg Days on Market

2024: 54

$558

Avg Price per Sq Foot

2024: $576